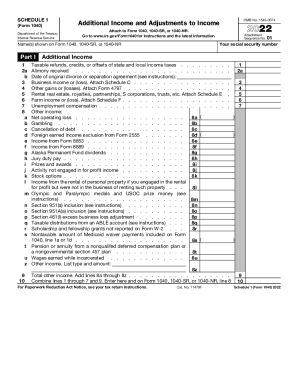

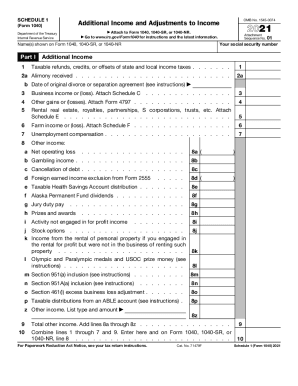

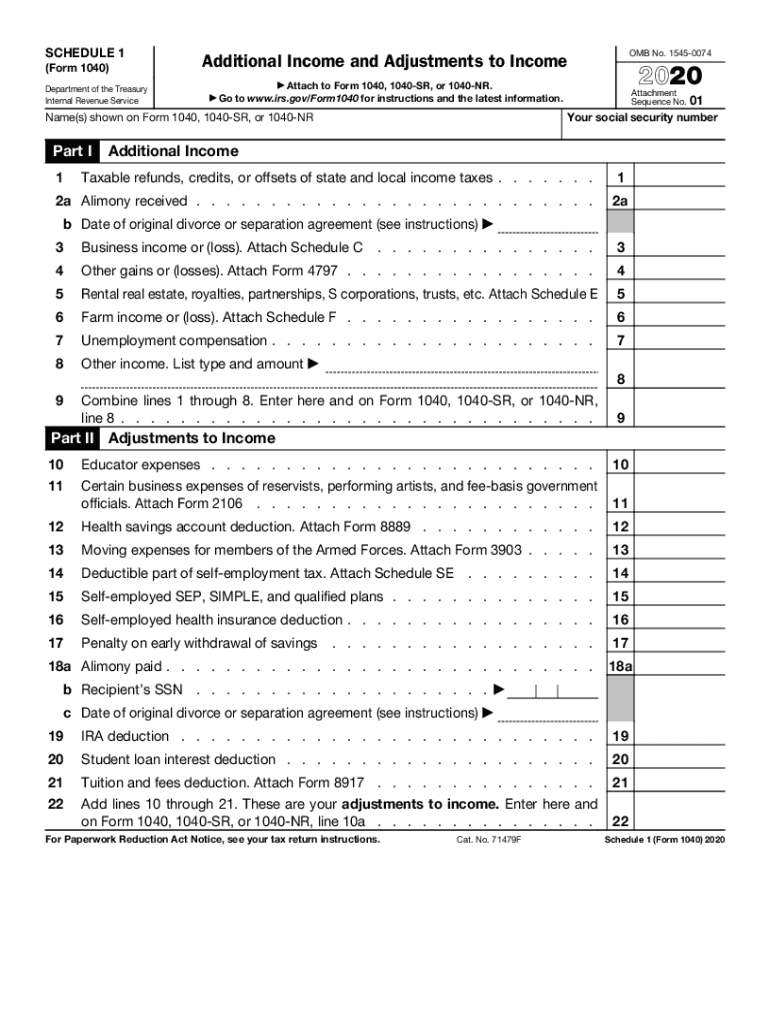

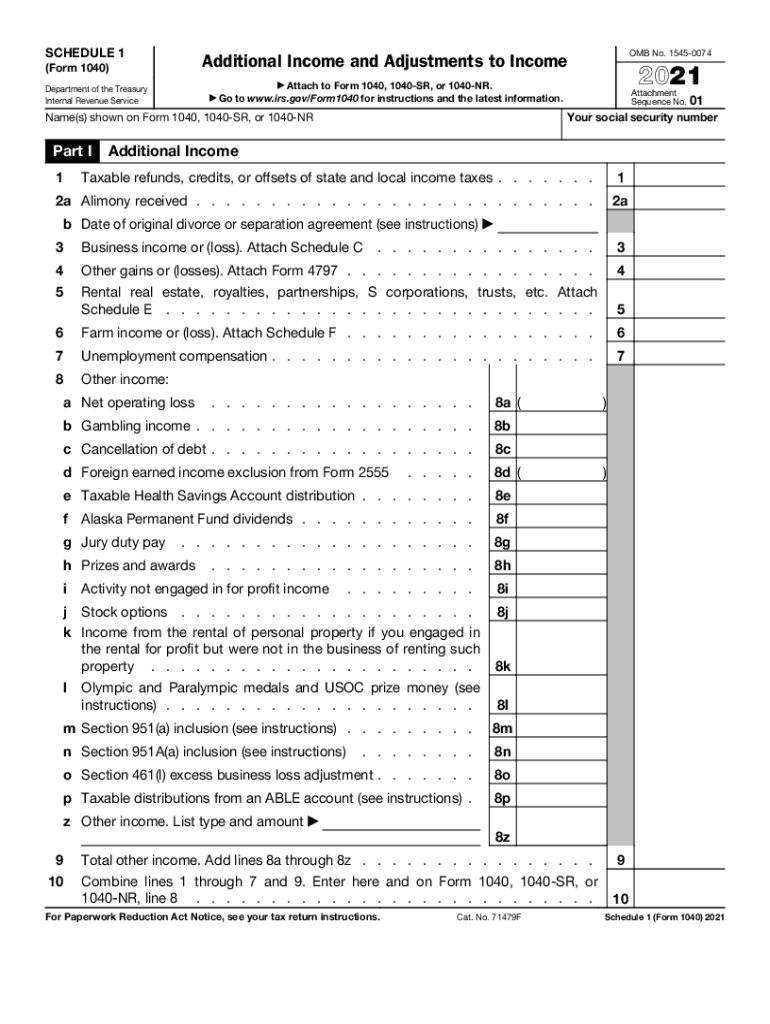

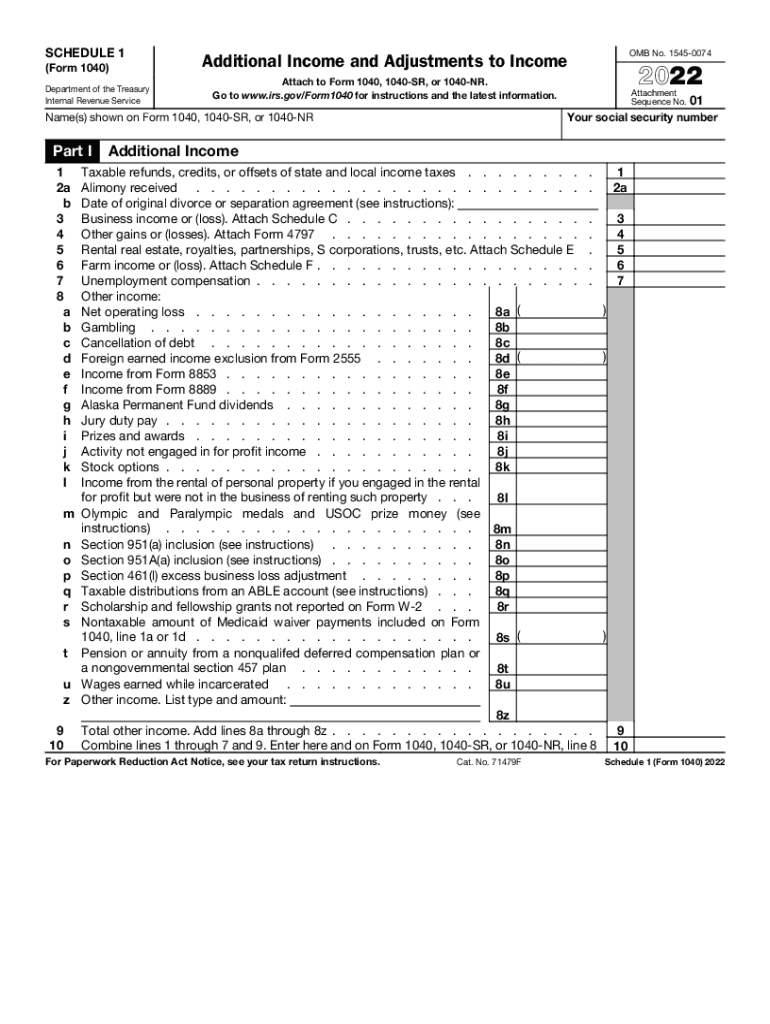

2024 Irs 1040 Schedule 1 Form – The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions that are not listed on the standard Form 1040. It includes sections for reporting . The money you win from placing bets on your favorite sports team is considered income, no matter how little. The IRS considers all winnings from gambling fully taxable, whether from a website, app, .

2024 Irs 1040 Schedule 1 Form

Source : www.uslegalforms.comWhat is IRS Form 1040 Schedule 1? TurboTax Tax Tips & Videos

Source : turbotax.intuit.comIRS 1040 Schedule 1 2021 2024 Fill and Sign Printable Template

Source : www.uslegalforms.com1040 (2023) | Internal Revenue Service

Source : www.irs.govSchedule 1: Fill out & sign online | DocHub

Source : www.dochub.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov2022 schedule 1: Fill out & sign online | DocHub

Source : www.dochub.com1040SCHED1 Form 1040 Schedule 1 Additional Income and

Source : www.nelcosolutions.com2022 schedule 1: Fill out & sign online | DocHub

Source : www.dochub.comAndrew Lokenauth | TheFinanceNewsletter.on X: “Tax Season is

Source : twitter.com2024 Irs 1040 Schedule 1 Form IRS 1040 Schedule 1 2022 2024 Fill and Sign Printable Template : If your state or local government requires you to collect sales tax, you only need to report lump sum amounts on Schedule C. Form 1040, Schedule C, Line 1 Report all money you collected in your . This includes items such as: You can also use other IRS schedules (additional forms) with Form 1040-SR, such as Schedules 1, 2, and 3, to report information not directly reported on Form 1040-SR. .

]]>